KSS Tactical Dislocation at Play. "Not Broken + Too Cheap”

“Buy broken stocks not broken companies” First observing the firm back when it was trading at $8 dollars a share and a -89% bottom turning into a 300% rally from its lowest price of $6 a share we delve into one of my favorite trades of 2025 and the credit analysis that drove the thesis.

5 years of data Kohls’s equity down -89% from it all time high to a 300% inflection point rally.

Chart Data: Koyfin

Valuation Dislocation

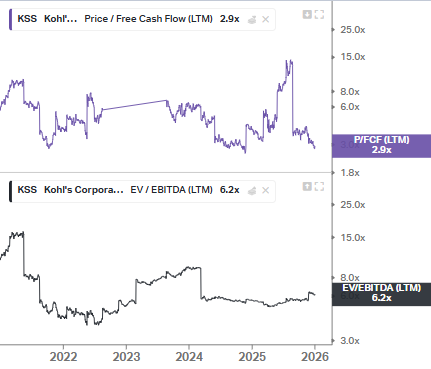

EV/EBITDA ~6x the market is pricing in low expectations for the firm. Equity upside often comes from improving sentiment and risk premium compressing you do not need EBITDA growth for upside this is good for rerating rallies which is our goal as it isn't proof of durable value for the firm. We are trying to capture multiple expansion not growth. Price / Free Cash Flow ~3x which is a low multiple (mispricing detector) a low number means fear priced in, so the stock already has bad news already as well as downside is protected unless free cash flow collapses. This offers a convex payoff, but upside may be capped unless capital allocation improves. Over-discounting, not Bankruptcy.

Chart Data: Koyfin

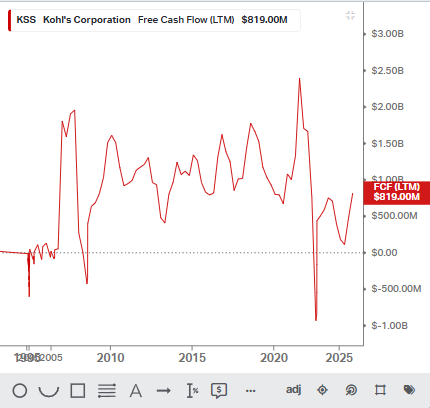

Cash flow Removes Left-Tail Risk:

When we look at tail-risk, we should look at it in three parts. Right tail-risk is a big upside surprise in equity, middle tail-risk accounts for normal wins and losses, left tail-risk is downside but not 10% drawdown we are referring to forced dilution, refinancing failure, and bankruptcy. Our Positive / Visible FCF removes left tail-risk, no immediate refinancing cliff. The Firms Free Cash Flow of $819.00M shows the firm can avoid dilution, stay solvent and support its current share price as it provides the firm with survivability.

Free Cash Flow Since Inception

Chart Data: Koyfin

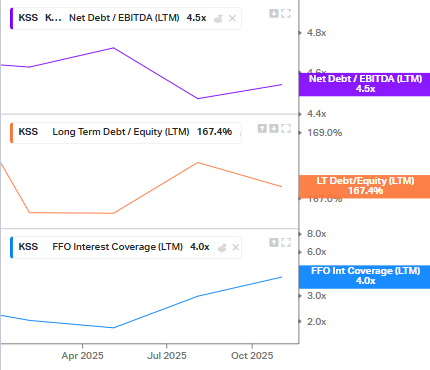

Net Debt / EBITDA (Equity Convexity) 4.5x the firm is highly leverage along with Long Term Debt to Equity being 167.4% which is bad long term but good in the short term, as the equity will move more per EV change. This brings us to Interest Coverage 4.0x the firms operating earnings are four times greater than it interest expenses KSS can combatable pay its debt interest almost agreeing with what FCF is saying in terms of staying solvent and avoiding dilution.

Chart Data: Koyfin

EV/EBITDA + FCF both say the business is cheap and equity is acting as a levered claim behaving like a call option on stabilization not in growth. Easing rates helps levered retail, and a small change in EV is a large equity move.

Chart Data: Koyfin

EV/EBITDA has already started re-rating we are in the Mid Phase where we are seeing multiples actively expand. The market is actively re-rating the business.

Mispricing's exists when:

• Cash Flow are real

• Market prices collapse risk too high

• Short time horizon

I would like to advice that we have been monitoring KSS since it was $8 a share and it has had an impressive run reaching over 300% but sitting up 250% from its $6 dollar low. Investing in any equity after such a move does involve inherent risk. This blog is to be taken as a record of research that went into the credit dislocation and not to be taking as a trade/investing signal.