30 Common Mistakes New Investors Make

Chasing hot stocks without research.

Ignoring diversification.

Overtrading to “time the market”

Letting Emotions dictate decisions.

Holding losing positions too long.

Selling winners too quickly.

Failing to have a written investment plan.

Neglecting fees and expenses.

Ignoring tax Implications of trades.

Following tips blindly.

Relying solely on past performance.

Not understanding the assets, they own.

Trading on rumors or social media hype.

Using Excessive leverage.

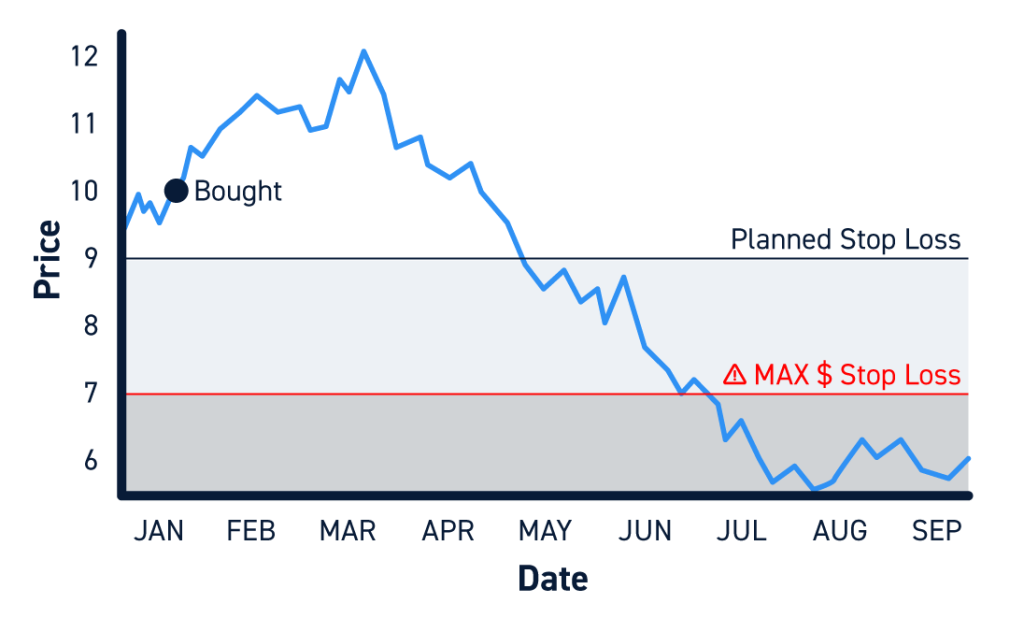

Failing to set stop-losses.

Overconfidence in personal predictions.

Ignoring macroeconomic trends.

Confusing speculation with investing.

Ignoring risk management strategies.

Failing to monitor portfolio performance.

Chasing dividends without accessing fundamentals.

Avoiding professional advice when needed.

Timing the market instead of time in the market.

Reacting impulsively to market volatility.

Putting all money in one sector or stock

Ignoring inflation and currency risks.

Believing “too big to fail” guarantees safety.

Not Rebalancing portfolio periodically.

Letting short term news dictate long-term strategy.

Neglecting continuous learning about investing.

“It’s good to learn from your mistakes. It’s better to learn from other people’s mistakes”

- Charles Munger