Rebalancing, Volatility & Bond ETFs…. A Passive Investor

What is Passive Investing?

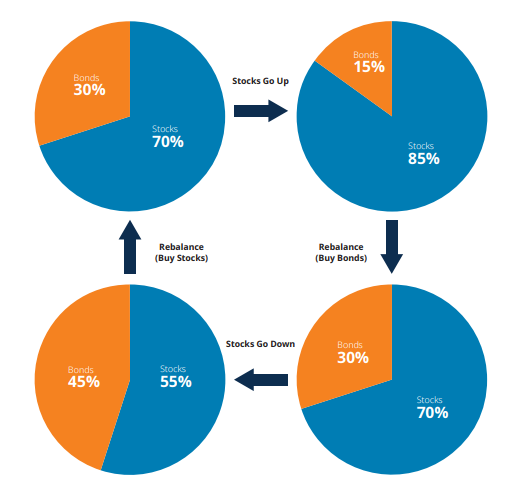

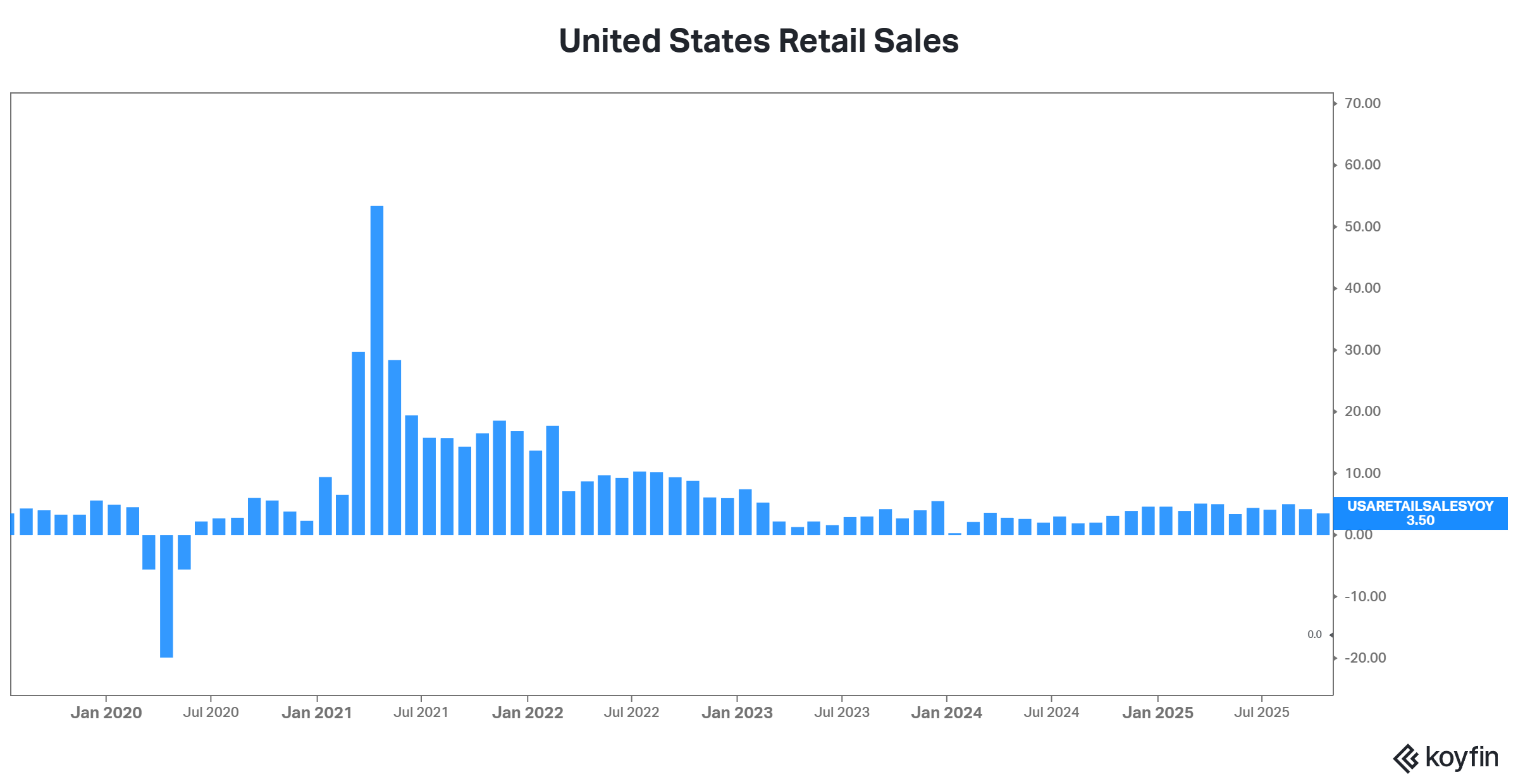

“Buy and Hold” the more common investment strategy to most market participants buying and holding a diversified portfolio of securities to mirror performance of a benchmark index. Passive investing doesn’t mean ignoring the bond market. Just like bonds don’t have to be boring to the already analytical market participant reading this report. In a period of elevated volatility, how and where you hold fixed income matters just as much as equity allocation. Today bond market is defined by a front-end-led steepening yield curve Short Term yields are falling as market prices in rate cuts as the market prices in Fed rate cuts. Long term yields are essentially flat at the time of writing after the December 9-10 rate cut to 3.75% the investor driven 10y is down 1.85% while the 2y is down 3.37%. Unfortunately, we are not in classic goldilocks while many analysts have been calling it one primarily because inflation is not reaccelerating the Fed is easing and market breadth is improving as the RSP is outperforming the SPY as well as long end yields being contained there is a slowdown in retail sales showing growth is slowing and everything is not “just right”. But let me slow down as this isn’t a sell all report the US consumer does face headwinds but is also being resilient during the holiday season. This is to point out that rebalancing your equity profit into bonds and repeating a cycle is one way we can reduce overall volatility on the portfolio during times of capital rotation.

Why Should Passive Investors Care?

Against popular belief bonds are not risk-free they carry duration and price risk, especially during shift in the yield curve. Rebalancing in this environment is not about timing the market its about preserving capital, reducing drawdown, and maintaining portfolio risk aligned with long term targets. In a front end steepening environment rotating bond exposure toward short and intermediate treasuries makes sense. In a goal to rebalance without market timing it’s important to maintain fixed target allocations, rebalance only when assets drift meaningfully from targets, and using bond ETFs to manage volatility not chase yield.

Final Takeaway

Passive investing works best when its disciplined even though long-term yields are flat, the falling short end combined with slowing retail sales creates an environment where front-end intermediate-duration treasuries are the risk adjusted sweet spot for investor managing equity risk.

A notable decrease in Retail Sales over the last 3 months