Savings Rates vs CPI Narratives. What Matters More?

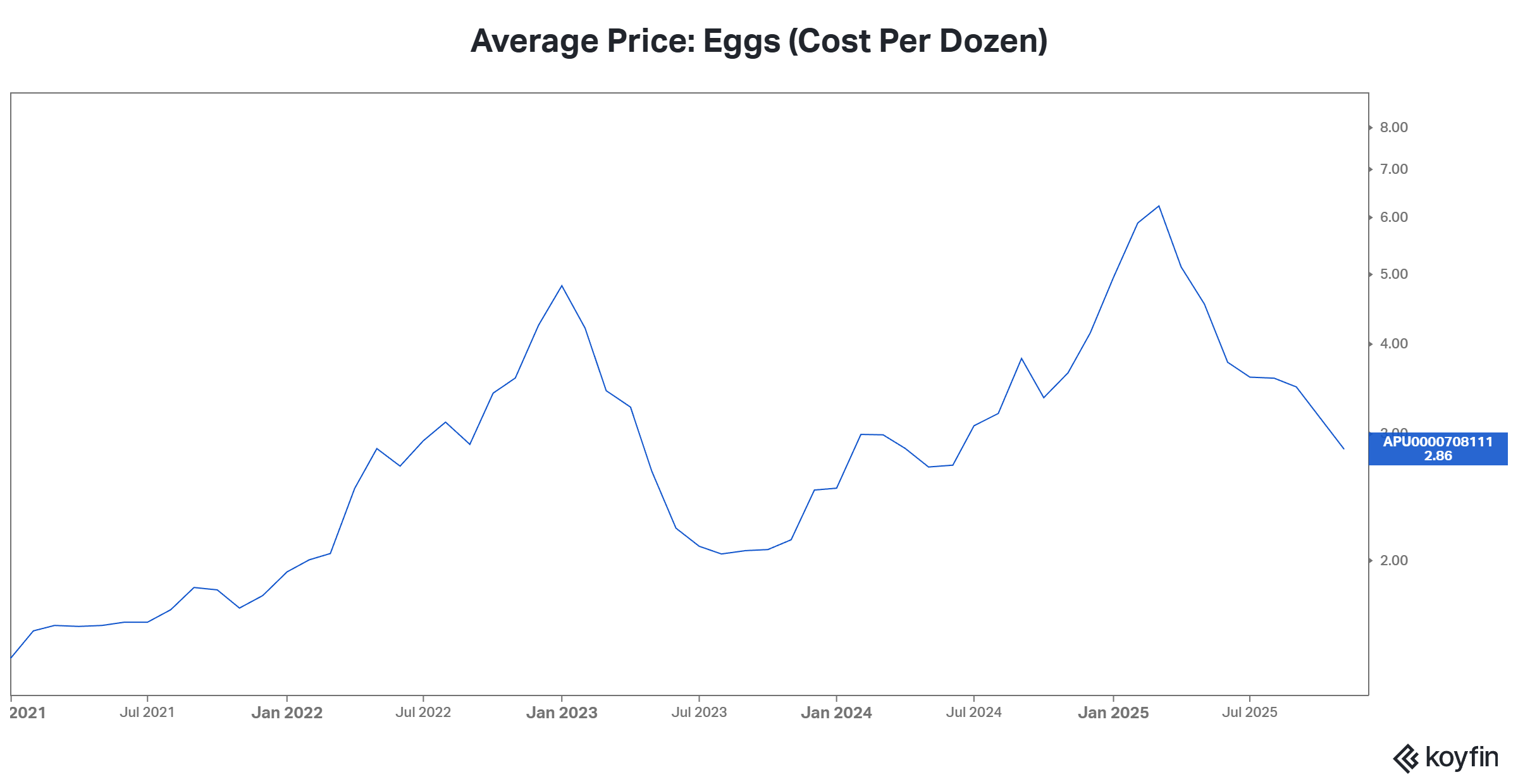

Watching hard earned dollars shrink when you didn’t even touch it is the best way to describe CPI how much prices for everyday goods and services increase each month. Virtually nobody reading this blog is a novice to inflation and dollars losing value overtime just in the last two years egg prices have rallied over 100%, although the rally didn’t come from monetary policy consumers felt the pressure of tight dollars when it came to breakfast time.

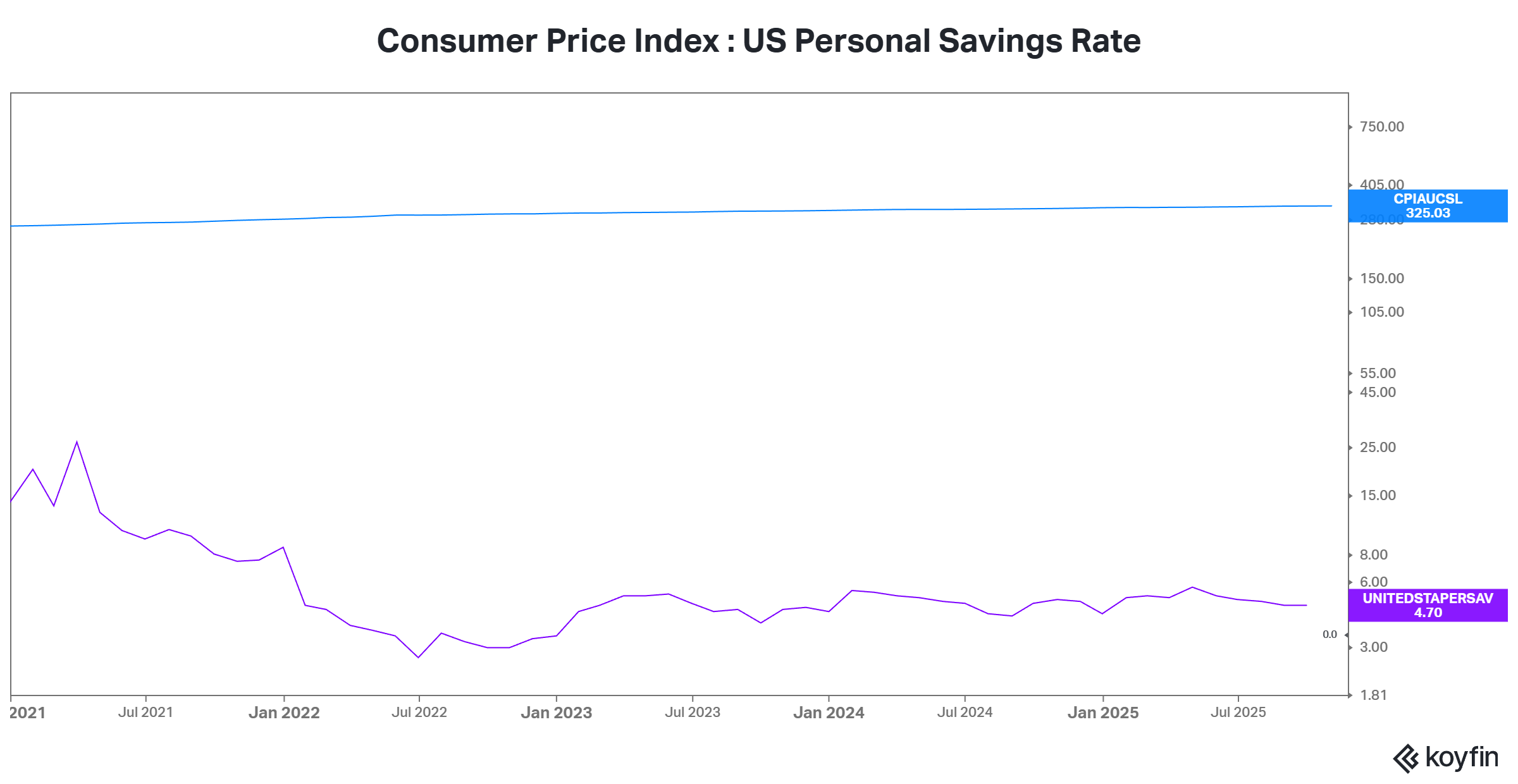

To be frank markets don’t care if egg prices are up 100% from the prior year. Before delving deeper, savings rates matter more than CPI narratives, saving rates tell you what households can actually do next, not what prices did last month. If we were to break up CPI and savings as investors CPI would be the price signal (backward-looking and lagging) whilst savings rates are forward looking and a measure of financial resilience amongst consumers. In the markets you can easily have high CPI and high savings which creates survivable demand. You can also have a falling CPI and low savings. That's where you see demand break and it becomes a very challenging economic scenario. Falling CPI initially increases the purchasing power of existing money. Low savings leave individuals vulnerable to economic shocks and be forced to take on high interest debt and face job losses that can accompany a broader economic slowdown.

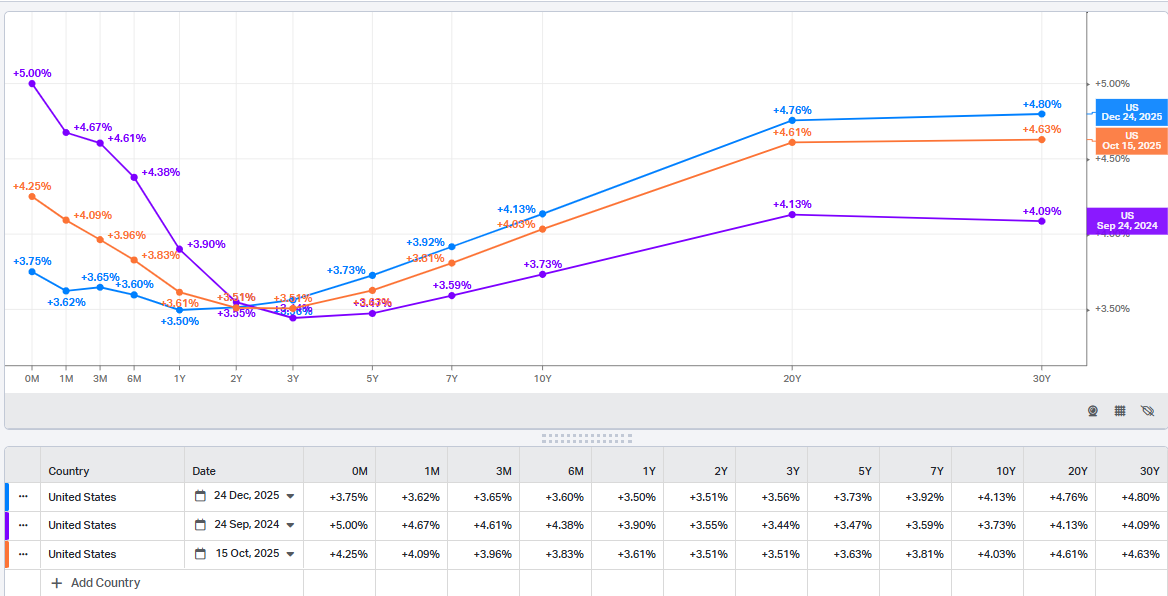

In our current environment we have rising CPI + flat or rising savings this often translates to households are absorbing higher prices without changing their behavior (spending habits). Where with falling CPI and falling savings demand breaks in a world characterized by rising CPI + flat or rising savings we see inflation but without the demand destruction. This also reverts to the bond markets logic of a bull steepener: inflation persists without demand destruction. In a bull steepening regime CPI stays elevated, savings are flat or rising, consumption doesn't roll over, and growth expectations stay alive money markets are whispering “The Fed will have to cut the front end eventually, but inflation risk prevents aggressive easing.” Creating the front end falling faster than the long end. Under the surface the front end of the curve is pricing in fed cuts and policy pivots whilst the long end is sticky and is anchored by inflation persistence, fiscal supply and growth durability.

Recession Steepner?

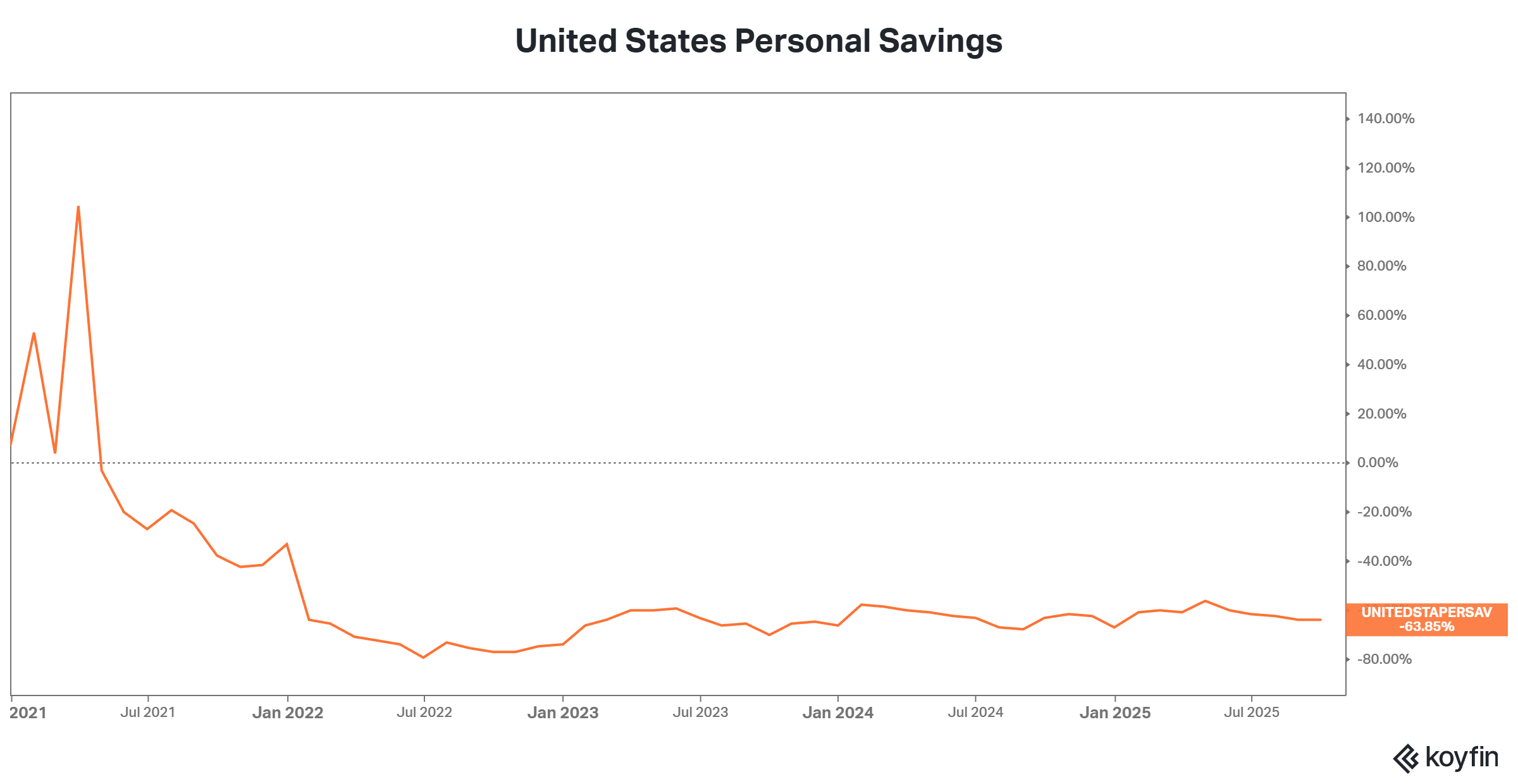

We've described both a flat CPI with flat savings and a rising CPI with flat rising savings, so which is doomsday? When savings are down and CPI is down the curve in a bull steepener that signals recession what we are swimming today isn't a recession it can be categorized as Monetary Policy to tight at the front end. In our current regime front end duration wins long end underperforms, equities don't crash EM & cyclicals can lead and credit holds until it doesn't, a recessionary trade would be long duration exploding higher equities break and Credit spreads widen. The point is savings rates tell us where we are. Currently inflation isn't self-correcting that can frustrate central banks as Terminal rates get repriced upward. Inflation only becomes bearish when households can no longer fund it.

CPI headlines tell you what's happening, savings tell you how long it can keep going. When households have exhausted excess cash and are credit constrained, that's when interest rates work or I should say only when. CPI narratives are political if consumers have adequate savings rate hikes take longer to slow consumption and inflation stays sticky regardless of CPI. On the other side a “good” CPI print doesn't save growth if consumer savings has diminished; the savings drawdown is what leads to recessions not CPI. Almost how pundit market analysts believe a recession was near if NVDA missed earnings. That would trigger a rebalance in tech fortunately if NVDA misses earnings the average American consumers can still go and enjoy a movie with popcorn stress free as it would have no effect on them.

Rising CPI + Flat or Rising Savings

United States Personal Savings down as post covid but flat over 3 years.